Financial Hegemonists

You might think that the news on two hedge funds Amaranth and Pirate Capital doesn't matter to the average person, but I think it does.

Even though they are called Hedge funds, they don't have to "hedge" anything. Many of them make a lot of money by borrowing most of it and speculating on price movements in stocks or commodities. It matters because the bull market has attracted a lot of hedge funds to open. They are pretty much unregulated, so anyone who can attract “sophisticated” investors and borrow money can set up shop.

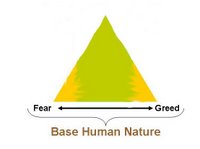

At least in financial markets, human nature moves between the feelings and actions of “fear” and “greed”. In this cycle “fear” was in mid-2002 when we had the scary Enron and Worldcom debacles and the invasion of Iraq and recently, we hit “greed” when oil reached about $80/ barrel. Now that oil is at $62 /barrel, I’m pretty sure we are now starting back towards “fear”.

Simple example 1:

In Mid-2002 the market is at “fear”.

Hedge fund buys $1 million of stock X and borrows $4 million to buy more of X. The stock increases 30% and because of the borrowed money there’s a 150% return on a $1 million investment. WOW!! “Sophisticated” investors flock to invest in the hedge fund.

Simple example 2:

Late 2006 the market is at “greed”

Hedge fund buys $1 billion of stock Y and borrows $4 billion more to invest in stock Y. Whoops...stock Y goes down 30% and because of the borrowed funds they've lost the $1 billion investment and can’t repay the $ 4 billion loan in full. It’s a 150% loss. HOLY COW!! Margin calls and screams of, "Get my money out of that fund!”

You can imagine that a fund can be a lot more nimble if it needs to sell $5 million of stock in a bull market than if it needs to sell $5 billion in a bear market. The problem is that no one really knows how many other hedge funds opened and decided to make the same exact bet that stock Y would go up. If everyone who borrowed a lot of money made the same bet that stock Y would go up and goes down 30%then we are all in trouble.

Now, imagine a similar scenario but just substitute “home buyers” for “hedge funds”. If too many people have placed the same bet counting on home price appreciation, then we’re all in trouble. I suspect we’ll all find out the answer in about 3 to 6 months.

No comments:

Post a Comment